Why Alphabet Stock Could Be the First Big Winner of the Robotaxi Race

Summarize this article with:

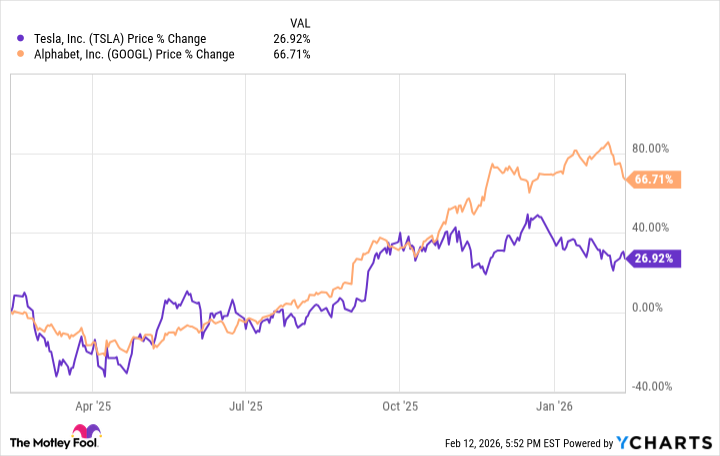

By Ben Gran – Feb 18, 2026 at 5:00AM ESTKey PointsWaymo plans to reach 1 million autonomous rides per week by the end of 2026.The company just unveiled its sixth-generation Waymo Driver, which it says will cut costs and improve performance on the road. These 10 Stocks Could Mint the Next Wave of Millionaires ›NASDAQ: GOOGLAlphabetMarket Cap$3.7TToday's Changeangle-down(-1.24%) $3.80Current Price$301.92Price as of February 17, 2026 at 3:58 PM ETThis major tech stock could be a big winner of the robotaxi race.The future of autonomous driving is already happening in several cities, and one company is leading the way in the U.S. market. Waymo, owned by Alphabet (GOOG 1.05%)(GOOGL 1.24%), is not the only robotaxi company in America; Tesla (TSLA 1.69%) is also developing its own autonomous driving technology. But Waymo has built a significant head start over Tesla in putting self-driving robotaxis on the road. And although robotaxis are not the only possible reason for this, Alphabet stock has strongly outperformed Tesla stock during the past year. TSLA data by YCharts Here are a few important reasons Alphabet stock could be the first big winner of the robotaxi race. Waymo is ready to grow fast In a recent interview with Bloomberg, Waymo co-Chief Executive Officer Tekedra Mawakana said that by the end of 2026, the company expects to reach more than 1 million paid robotaxi rides per week in the U.S. That would be a 150% increase compared to its current rate of 400,000 rides per week. The company is currently operating in six U.S. cities, including Los Angeles, Atlanta, and Phoenix. It plans to expand its autonomous ride-hailing services to 20 new cities this year, including London and Tokyo. Image source: Waymo. Waymo might have a technological edge On Feb. 12, Waymo announced the launch of its sixth-generation Waymo Driver. The company says that this new technology will bring improvements in Waymo cars' ability to see and sense the world around them. This includes a new high-resolution sensor with 17 megapixel imaging, and sixth-generation LiDAR (light detection and ranging) digital sensor technology. Waymo says that the new Waymo Driver technology will enable it to improve its robotaxis' driving capabilities (especially in rain and snow), while operating at lower costs. The company is also scaling up production of Waymo vehicles at its factory in Phoenix, with a goal of "tens of thousands" of vehicles per year. Tesla offers what it calls Full Self-Driving (FSD) technology, but it has not yet been able to offer a passenger-ready robotaxi service at the same scale as Waymo.

The Tesla Robotaxi ride-hailing service has rolled out only in Austin, Texas, and most cars still have human safety supervisors at the wheel. The company also offers a ride-hailing service in California with human drivers. ExpandNASDAQ: GOOGLAlphabetToday's Change(-1.24%) $-3.80Current Price$301.92Key Data PointsMarket Cap$3.7TDay's Range$296.26 - $304.3852wk Range$140.53 - $349.00Volume4.2KAvg Vol38MGross Margin59.68%Dividend Yield0.27% We're still in the early days of autonomous driving. We don't know how profitable robotaxi services will be, or how much they will add to Alphabet's stock price. But Waymo seems to be the clear winner of the robotaxi race in 2026. If I wanted to invest in the future of robotaxis, I'd buy Alphabet stock.Read NextDec 16, 2025 •By Matt DiLalloWhat Google's New Deal Means for Energy InvestorsJul 31, 2025 •By Jeremy BowmanAlphabet's Recent Numbers Were Strong, but This Metric Could be a Red FlagMar 22, 2020 •By Matt DiLalloHow I'm Investing During These Turbulent TimesNov 28, 2018 •By Neha Chamaria3 Stocks That Could Help You Send Your Kids to CollegeJun 14, 2018 •By Brian Feroldi3 Stocks the World's Best Investors Are Buying Right NowJan 11, 2018 •By Travis HoiumIs Energy Storage the Key to Unlocking the "Smart" in Smart Homes?About the AuthorBen Gran is a contributing analyst at The Motley Fool, covering publicly traded companies in consumer goods, technology, transportation, industrials, materials, and energy. He is a longtime freelance finance writer with 15+ years of experience writing for publications like Forbes Advisor, Motley Fool Money, and Business Insider, and corporate websites of Prudential and regional banks. Ben also ghostwrites books and bylines for CEOs and other business thought leaders. He earned his B.A. in History from Rice University. Ben is an avid international traveler and has visited 12 countries (and counting).TMFBenjaminGranStocks MentionedAlphabetNASDAQ: GOOGL$301.92 (1.24%) $3.80TeslaNASDAQ: TSLA$410.40 (1.69%) $7.04AlphabetNASDAQ: GOOG$302.82 (1.05%) $3.20*Average returns of all recommendations since inception. Cost basis and return based on previous market day close.