Nvidia’s China chip problem isn’t what most investors think

Summarize this article with:

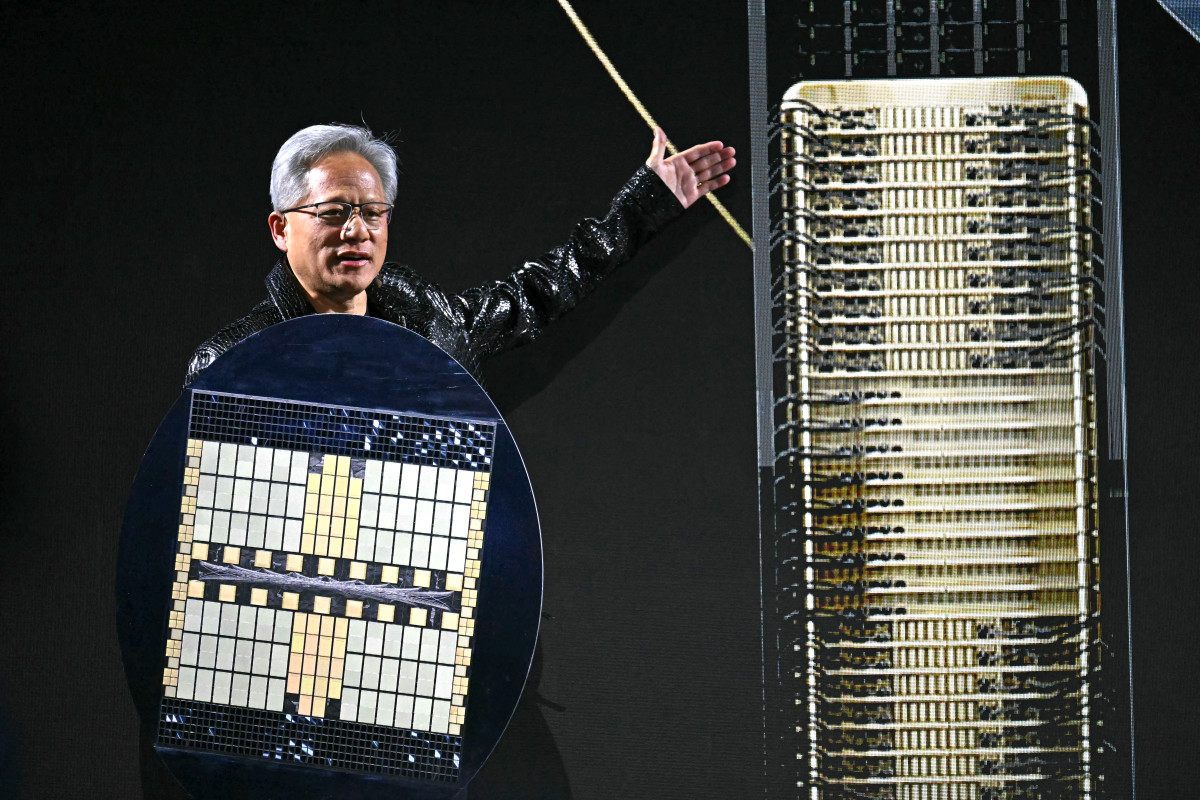

BABANVDAKey PointsNvidia’s H200 has quietly drawn strong interest from Chinese tech buyers, creating pressure points behind the scenes.Beijing is taking a measured approach to H200 access while doubling down on support for homegrown chip efforts.Nvidia’s China exposure remains fluid, shaped more by policy decisions than by customer appetite.Nvidia’s H200 processor is becoming the epicenter of a conflict in China, and stock market experts and investors cannot see it on a chart. Chinese cloud and internet corporations want Nvidia’s processor right now, since their own accelerators aren’t fast enough. Beijing, on the other hand, is looking at the big picture and may be ready to give up short-term success in exchange for control over its semiconductor future. One overlooked AI chip is now central to Nvidia’s China exposure. — Source: Fallon/AFP via Getty Images Since 2018, Washington has levied new tariffs on nearly $370 billion worth of Chinese imports. Trade organizations claim this package currently means that products arriving from China have to pay about $77 billion more in taxes each year. The trade war between the U.S. and China is unlikely to subside anytime soon. The conflict intensified in the incumbent administration. However, the previous government made every effort to minimize China’s “unfair” advantage. Katherine Tai, who served as U.S. Trade Representative from 2021 until January 2025, put it plainly in a 2024 statement. After thorough review of the statutory report on Section 301 tariffs, and having considered my advice, President Biden is directing me to take further action to encourage the elimination of the People’s Republic of China’s unfair technology transfer-related policies and practices that continue to burden U.S. commerce and harm American workers and businesses. Taking stock of the situation is important for Nvidia. The business has previously downplayed China in its predictions, but the H200 is still the most powerful AI processor that Chinese clients can lawfully purchase from the U.S. How much of Nvidia’s potential is still related to China and how much is gone for good will depend on whether it ever ships into the market at volume. Corporate China is still chasing Nvidia’s H200 The demand for Nvidia’s H200 in China is already more than what the firm can currently make, according to a Reuters report. The news outlet said Nvidia has informed Chinese customers that it is thinking about adding H200 capacity, since big buyers like Alibaba and ByteDance are very interested, even if the company is mostly focusing on its newer Blackwell and future Rubin processors. View post: You won’t believe what Coca-Cola just did with its coffee brandInvestingYou won’t believe what Coca-Cola just did with its coffee brandA high-profile coffee deal has suddenly become complicated for Coca-Cola.Faizan Farooque 0 KO Reuters also said that Chinese cloud service providers and business clients have been asking Beijing officials to approve H200 imports, saying local accelerators still don’t come close to the sheer computing power of the H200. Reuters spoke to one investor who indicated that the H200 is about two to three times faster than the most sophisticated AI processors made in China. This makes it the best processor Chinese purchasers can access without breaking U.S. export laws. That difference in performance is causing a lot of anger on the ground. Some Chinese authorities have suggested a solution that would allow H200 imports only if they come with native accelerators. This would help domestic chipmakers while still allowing businesses to use Nvidia’s technology. Key points for Nvidia investors: Chinese cloud and internet platforms still think Nvidia is the best choice for performance. In China, there is enough demand for H200 to put a strain on Nvidia’s present supply. Any access to H200 is likely to come with strings attached, such as obligations to bundle with competitors in the same country. For investors, all of this makes one thing clear: Nvidia’s silicon is still in demand in China’s data centers. Policy, not demand, is what’s holding things up. Beijing would rather back Huawei than buy more Nvidia Bloomberg’s report shows that Beijing is not as excited as its tech companies are. David Sacks, the White House’s AI and crypto czar, informed the outlet that China is deliberately rejecting Nvidia’s H200 in favor of chips made in China. Sacks stated that Chinese authorities had “figured out” Washington’s strategy of only permitting exports that are behind the curve. They are using their own clearance procedure to slow down H200 shipments and safeguard local producers. View post: US Navy bets $448M on Palantir AI to speed shipbuildingInvestingUS Navy bets $448M on Palantir AI to speed shipbuildingFew outside the Pentagon understand what’s unfolding.Faizan Farooque 0 GDHIIPLTR Bloomberg also said that China is thinking about giving its semiconductor sector up to $70 billion in new incentives. That package would be meant to speed up the country’s drive for self-sufficiency, with businesses like Huawei at the core, even if U.S.-approved Nvidia chips are technically accessible. Bloomberg is saying that Beijing sees the H200 as a short-term convenience that it is ready to give up in order to build up its own champions. It seems as if Nvidia really listened to that message. Bloomberg said the business has already taken China out of its short-term revenue forecasts, even though CEO Jensen Huang thinks the Chinese data center sector is worth around $50 billion a year, according to CNBC. H200 sales in China might potentially reach roughly $10 billion a year, but only if Beijing lets in a lot more imports, estimates show. What this means for Beijing’s strategy: Beijing is using approvals to slow H200 adoption and shield local chipmakers. Subsidies and incentives are being scaled up to pull AI workloads onto domestic silicon. Nvidia is planning as if China is upside optionality, not a core growth driver. Why the H200 standoff matters for Nvidia stock When you put the two stories together, you have a two-level game on which investors need to keep a careful eye. There is talk about urgency and pent-up demand at the business level. Chinese IT businesses prefer H200s because they still work better per chip than chips made in China. The longer they wait, the more likely they are to lag behind competitors across the world that already have Blackwell-class gear. At the same time, there is deliberate caution at the state level. Beijing appears to be increasingly keen on utilizing subsidies and clearances to give local suppliers an edge, even if it means AI rollouts for its own firms may take longer in the short term. More Nvidia: Is Nvidia’s AI boom already priced in? Oppenheimer doesn’t think so Morgan Stanley revamps Nvidia’s price target ahead of big Q3 Investors hope good news from Nvidia gives the rally more life Bank of America resets Nvidia stock forecast before earnings AMD flips the script on Nvidia with bold new vision For Nvidia stockholders, the difference between what China wants and what Beijing is ready to allow is an uncertainty premium. Nvidia has assured clients that any licensed H200 sales to China will not stop it from serving U.S. customers, according to Reuters. This shows that the company is confident it can service both markets if it receives the go-ahead. Bloomberg’s research, on the other hand, shows that investors can’t trust that green light would ever come at a large scale, at least not without rigorous restrictions that also help Chinese rivals. Implications for Nvidia’s long-term setup include the following. Money coming in from China may not be a steady source of development, but it may be lumpy and based on policy. If domestic Chinese accelerators don’t have to compete with Nvidia, they may become better quicker. Nvidia’s multiple may start to show how much it is exposed to the U.S. and other “open” AI markets, with China seen as a call option. If Beijing lets in a small number of strictly controlled H200 imports, Nvidia might get back billions of dollars in extra sales from a market it has mostly given up on, while also making people think that its chips are still the best in the world. Nvidia’s business in China may continue to be fundamentally weak, no matter how loud the demand is, if approvals are limited or take a long time. What Nvidia investors should watch next The H200 is no longer Nvidia’s most advanced product, but it is a good way to see how much more the business can expand in China under the present export rules. Bloomberg’s article makes it clear that the key issue is no longer whether the H200 is good enough (it is), but whether Beijing is still ready to allow U.S. export policy to determine its AI agenda. According to Reuters, Nvidia is still the most popular option in China when it comes to data centers, as long as purchasers can acquire it. For Nvidia investors, the setup is simple: If clearances start to go through or if Beijing starts to change its attitude on H200 imports, it might mean that Nvidia’s China forecast is not completely priced in. A hard turn to indigenous chips, supported by big subsidies and stricter unofficial rules, would show that Nvidia has to develop in places other than China. In any case, the H200 debate is less about one “old” chip and more about how Wall Street should evaluate China’s risk across all of Nvidia’s AI products over the next several years. View post: Tesla has problem no one was pricing inAutomotiveTesla has problem no one was pricing inThe advantage isn’t where you think.Faizan Farooque 0 NIOTSLAXPEV About the authorsFaizan FarooqueFaizan Farooque is a financial markets writer with nearly a decade of experience covering equities and macro-technology themes. He has contributed to TheStreet, MT Newswires, GuruFocus, and InvestorPlace, delivering breaking news, earnings coverage, and data-driven stock analysis for retail and institutional audiences. Faizan is a generalist who regularly writes about technology, consumer discretionary stocks, and economics.He previously worked at S&P Global as a data analyst, honing his fundamentals and contributing occasional news pieces. His current work focuses on corporate earnings, valuation trends, and digital-asset strategy, combining rigorous research with clear, AP-style reporting.Celine ProviniCeline is a writer and editor with over 20 years of experience and has covered diverse news, features, academic/research, and legal topics. At TheStreet.com, Celine is a senior editor with experience across retail, stocks, investing, personal finance, technology, the economy, and travel. Start the Conversation