Health care costs are the wild card in year-end tax planning

Summarize this article with:

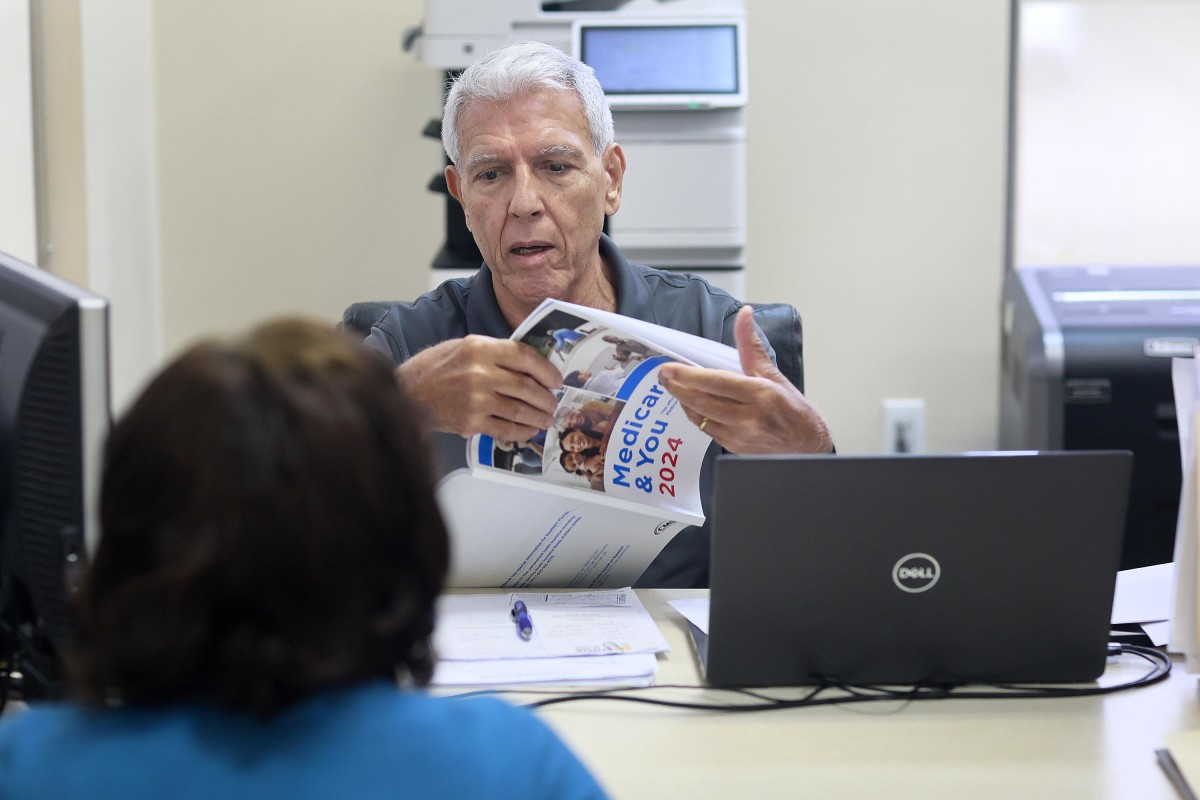

As the year draws to a close, financial experts are quick to roll out familiar tax-saving advice.They urge taxpayers to time income and expenses, either accelerating deductions into the current year and deferring income into the next, or doing the reverse, depending on circumstances. They recommend fully funding tax-deferred retirement accounts to help reduce taxable income.Investors are also encouraged to harvest capital gains and losses, make charitable gifts or contributions to donor-advised funds, or consider qualified charitable distributions from an IRA.Other common year-end tips include maximizing contributions to a health savings account for those enrolled in a high-deductible health plan and using flexible spending account dollars before the “use it or lose it” deadline.But one critical tax consideration is often overlooked.Health insurance costs, and their direct connection to taxable income, deserve a place on every year-end to-do list, said Jae Oh, author of "Maximize Your Medicare." In an interview, Oh explained why health care planning has become inseparable from tax and retirement planning. What follows is an edited transcript of that conversation, revised for clarity and brevity. Medicare expert Jae Oh explains why taxable income, health insurance, and retirement taxes can no longer be planned in isolation.Photo by skynesher on Getty Images Year-end planning is more than taxesRobert Powell: It’s year-end, and for folks who are fond of to-do lists, we’ve got one for you. I’m speaking with Jae Oh, author of "Maximize Your Medicare." Jae, this is one of my favorite times of year and one of my favorite topics. Where do we begin?Jae Oh: Most year-end headlines focus on tax-loss harvesting in the securities markets, and that will continue to dominate the conversation. But recent headlines around the Affordable Care Act have highlighted a research note I wrote nearly two years ago. The principles still hold true today with little modification.Health insurance is a major source of uncertainty in financial and retirement planning. Every household is different, and that means the accommodations people need to make vary widely. What many people still do not fully understand is that when you purchase health insurance on your own, at any stage of life, the cost is directly tied to taxable income.While we talk about tax-loss harvesting, short-term and long-term capital gains, and qualified dividends, there is another ripple effect. Taxable income affects your health insurance costs. And if you are 65 or older, it can also affect Medicare IRMAA. All of this has come into sharper focus because of the fast-moving debate in Washington over the Affordable Care Act.Robert Powell: You often say these decisions cannot be made in a silo. As people think about a year-end to-do list, they are also trying to plan ahead for 2026. That means looking back at provisions of the One Big Beautiful Bill Act and understanding how things may change, whether it’s the senior deduction, SALT provisions, or other elements that could affect them going forward.Tax law changes add new complexityJae Oh: This year is this year, and the final days of 2025 are especially eventful.

The One Big Beautiful Bill Act changed several important tax provisions, including the new senior deduction. That deduction has not been fully understood. Some people assume it means their Social Security is no longer taxed, but that is not precisely the case.What it does mean is that retirees will have different levels of access to cash on a post-tax basis. From a financial planning perspective, the objective is to maximize post-tax cash flow in retirement. With tax law changes, ongoing scrutiny of the Affordable Care Act, and Medicare IRMAA still in place, planning has become more complicated.Robert Powell: There’s that old saying that it’s not what you earn, it’s what you keep. When I think about tax-efficient income, I think about pulling money from taxable accounts, Roth accounts, or pretax IRAs and 401(k)s in a way that produces the most post-tax income, not just for one year, but over the long term.Planning for post-tax income, not just this yearJae Oh: That’s exactly right. Creating multiple sources of income so you can access cash on a post-tax basis takes timing, preparation, and execution. You have to understand how these tax rules work before you decide when and how to use your money.Robert Powell: For people who feel it may be too late to do much this year, it’s not too early to start a to-do list in January for the 2026 tax year.Jae Oh: That’s absolutely true. Many studies show that tax-loss harvesting should be a year-round process. The same applies to health care cost planning. The debate in Washington has made it clearer that health insurance costs are tied to taxable income and can change dramatically.For our clients, we start by examining health care considerations first. That helps us estimate the weighted average life, or duration, of the portfolio. When you understand a household’s health, age, and personal circumstances, it affects the time horizon you are planning for. Once that is clear, strategies such as Roth withdrawals, conversions, and contributions can be put into proper context.Key takeawaysHealth insurance and Medicare costs are directly tied to taxable income.Tax decisions can trigger higher premiums or Medicare IRMAA.New senior tax deductions do not eliminate Social Security taxation.Maximizing post-tax income matters more than minimizing one-year taxes.Health and longevity assumptions should shape withdrawal strategies.Related: If your Medicare plan was canceled, do this now