Ford turns a setback into a win

Summarize this article with:

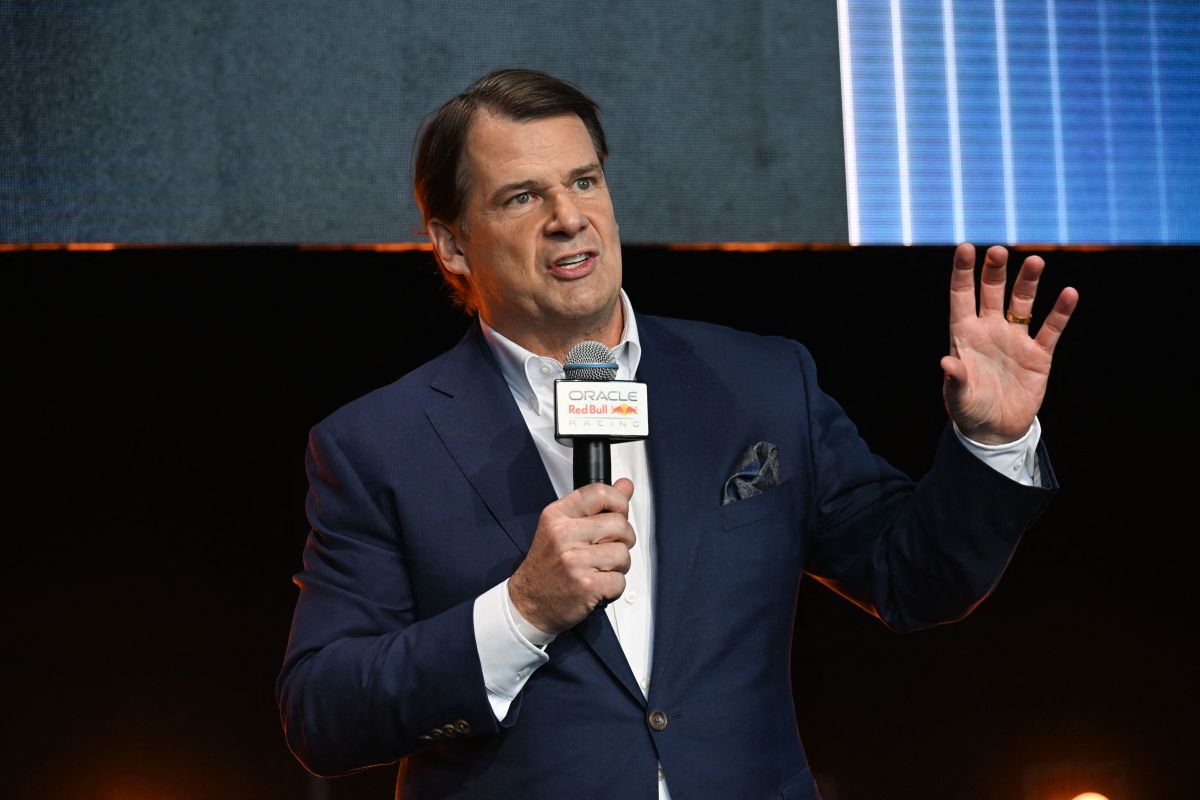

Ford stock is down today, trading about 2.4% lower near $13.3 at the time of writing. Gains of 28% in the past six months face risk after the company announced on Dec. 15 it is taking a $19.5 billion pre-tax write-down on its electric vehicle division over the next two years and shifting production away from EVs toward hybrid and extended-range vehicles.While the stock market didn’t react negatively to the news, it did so following Ford’s cancellation of a $6.5 billion battery agreement with LG Energy Solution, as reported by Bloomberg on December 17. This cancellation poses a significant problem for LG Energy, as the amount is equivalent to more than a third of LG’s total revenue last year, and it also sends a clear message that the EV sector is in a challenging position.Pivoting a business is never easy, but fortunately for Ford, there is a silver lining. Ford is launching a Battery Energy Storage System (BESS) Business.Photo by FourFour on Unsplash Ford is launching a Battery Energy Storage System BusinessIn its statement about shifting away from EVs, Ford (F) also revealed plans to repurpose existing U.S. battery manufacturing capacity in Glendale, Kentucky, to serve the battery energy storage systems (BESS) market. The company also plans to invest approximately $2 billion over the next two years to scale its business.By converting the Kentucky site to manufacture 5 MWh+ advanced battery energy storage systems, Ford hopes to capture the growing demand for battery energy storage from data centers, driven by the AI boom. The company intends to bring initial capacity online within 18 months and to deploy at least 20 GWh annually by late 2027.Why batteries for data centers are such a big business opportunityThe most obvious use case for batteries in data centers is backup power systems. For example, Google has a data center in Belgium, where it installed the first-ever battery-based system, replacing generators at a hyperscale data center. However, as we’ll see, there are other reasons why this presents a significant opportunity for Ford.“Newer and larger data centers are being built at a rate that exceeds the support infrastructure that supports it – notably, the traditional power utilities’ ability to supply sufficient electricity,” Bob Johnson, VP analyst at Gartner, wrote in his research paper, as reported by The Register. According to the same paper by 2028, “only 40 percent of all new data centers will rely solely on power delivered via the electricity grid network.”Related: Ford CEO takes subtle shot at Tesla Cybertruck after $20 billion hitThe faster a data center gets running, the better. Sometimes, due to the constraints mentioned by Gartner, shortcuts are taken. xAI’s Colossus is a prime example of that, as it runs on gas turbines and is not connected to the power grid. In fact, to solve this problem, Elon Musk has acquired an overseas power plant and is shipping the entire facility to the U.S., as reported by Tom’s Hardware.“New solar and battery facilities can be up roughly in a year, while it may take five years for gas-turbine power,” Goldman Sachs Research's Carly Davenport wrote.Another reason batteries are important for data centers is that the centers don’t just pay for electricity by the kilowatt-hour. According to EticaAG, data centers pay for the amount of power they use at their highest 15-minute interval each month in the form of demand charges, and BESS can trim operating costs by capping power spikes and avoiding costly demand charges.How Goldman Sachs and Morgan Stanley rate the Ford stockGoldman Sachs analyst Mark Delaney reiterated a hold rating for Ford and raised the price target from $13 to $14 on Dec. 16. Delaney believes that Ford’s realignment and restructuring are expected to improve profitability by reducing Model e losses and shifting production toward higher-margin Blue and Pro vehicles, as reported by TipRanks. More Automotive:Waymo drives on freeways: what’s nextFord CEO Jim Farley gets real about his retirementUS auto giants give car buyers mixed messages about EV plansTesla fatal crash lawsuit takes a wild turnThe consensus rating for Ford is "hold," based on 17 analyst ratings, of which 12 are "hold," and the average target price is $12.04, according to MarketBeat. On Dec. 8, Morgan Stanley initiated coverage of Ford with a hold rating and a $14 price target. Morgan Stanley believes the electric vehicle “winter” will sustain through 2026, but will be counterbalanced by a “moderately more positive” outlook on internal combustion engines and hybrids, as reported by TipRanks.Related: Honda forced into another recall over potentially dangerous issue